Discover how directed fire risk management can not only reduce insurance premiums but also enhance coverage options.

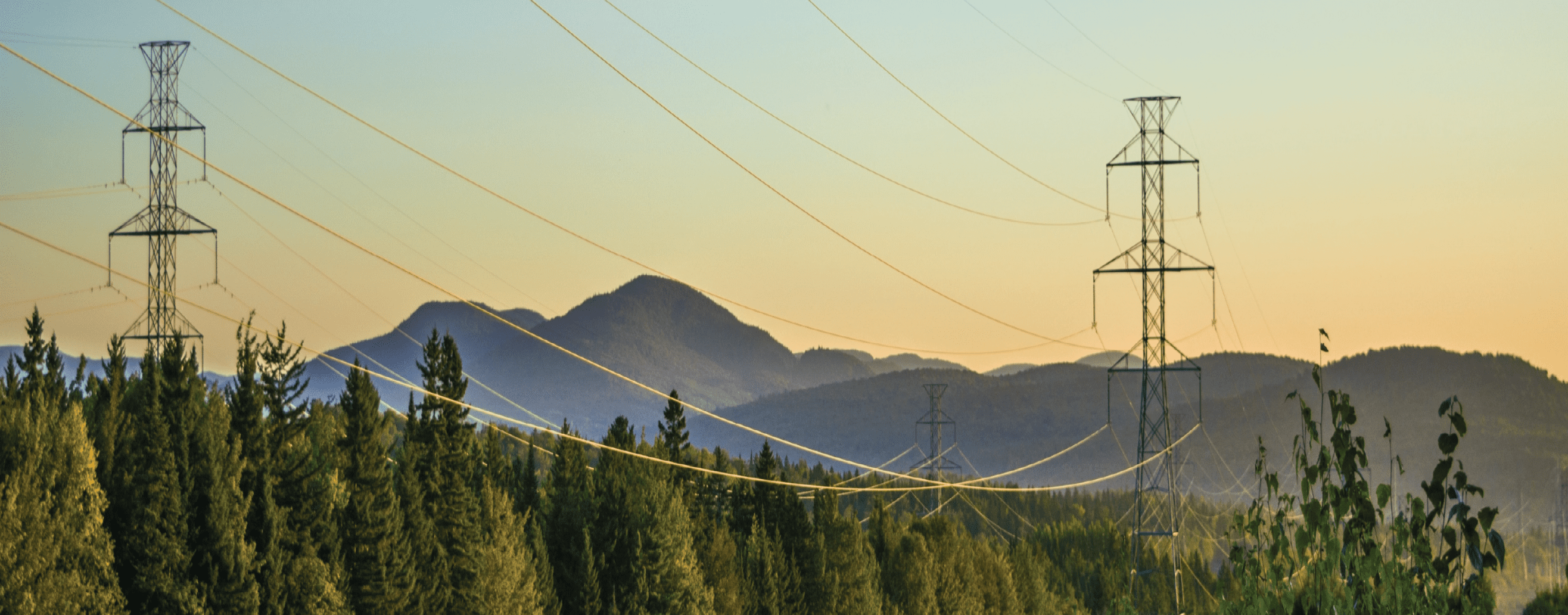

In the energy infrastructure sector, fire risk is a significant concern that directly impacts operational costs, safety, and insurance premiums. As wildfires become more frequent and intense, energy companies face the dual challenge of mitigating these risks while managing escalating insurance costs. Echospectra’s strategic fire risk abatement tools offer a proactive solution that not only reduces fire hazards but also lowers insurance premiums and enhances coverage options.

The Financial Burden of Fire Risk

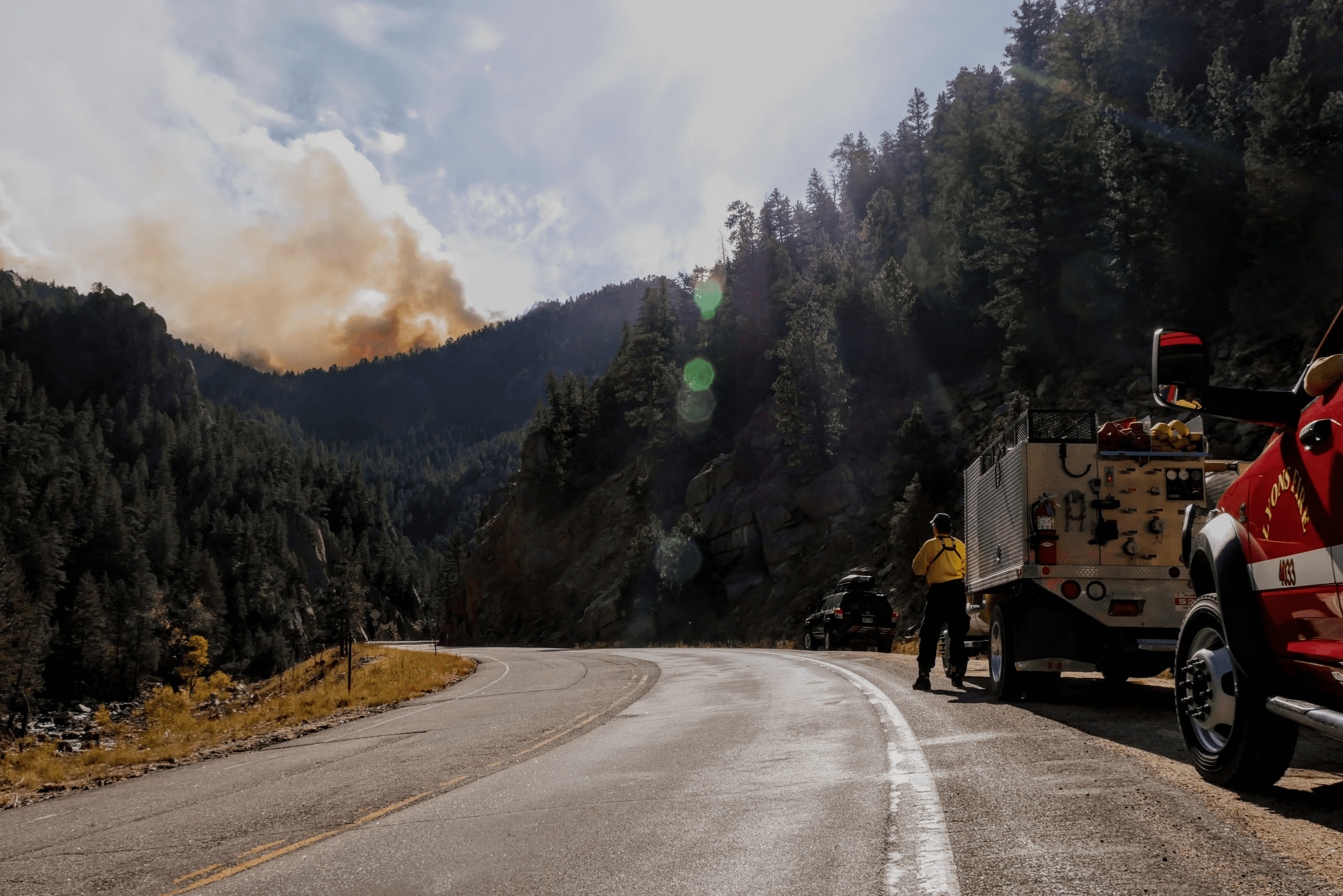

Wildfires pose a substantial threat to energy infrastructure, leading to power outages, extensive damage, and high recovery costs. Insurance companies, in turn, respond to increased risk by raising premiums, imposing stricter coverage terms, or even withdrawing coverage altogether. This creates a financial strain on energy companies, necessitating innovative approaches to fire risk management.

Our Solution: Proactive Fire Risk Abatement

Echospectra’s fire risk abatement tools leverage advanced technology to provide targeted and effective fire risk management. Here’s how our solution can transform your fire risk strategy:

- Comprehensive Risk Mapping: Utilizing multispectral satellite imagery, our platform assesses vegetation health, soil moisture, and fuel load. This data allows us to create detailed risk maps that highlight areas with the highest fire potential.

- AI-Driven Insights: Our AI algorithms analyze environmental data to predict fire risks accurately. By identifying trends and patterns, our system enables energy companies to take proactive measures before risks escalate.

- Targeted Mitigation Strategies: Based on our risk assessments, we provide actionable recommendations for vegetation management, such as prioritizing high-risk areas for clearing and maintenance. This targeted approach ensures that resources are used efficiently and effectively.

- Real-Time Monitoring: Echospectra’s tools offer real-time monitoring of fire risk factors, allowing

for timely interventions. Our platform continuously updates risk assessments based on the latest

data, providing ongoing protection against emerging threats.

Benefits of Strategic Fire Risk Abatement

Implementing Echospectra’s fire risk abatement tools offers several key advantages:

- Reduced Insurance Premiums: By demonstrating proactive risk management and effective mitigation strategies, energy companies can negotiate lower insurance premiums. Insurers recognize the reduced risk exposure, leading to cost savings.

- Enhanced Coverage Options: Companies that actively manage fire risks are more likely to secure comprehensive insurance coverage. Proactive measures can make insurers more willing to offer better terms and broader coverage options.

- Operational Resilience: Effective fire risk management enhances the resilience of energy infrastructure, reducing the likelihood of service disruptions and damage. This reliability boosts customer trust and satisfaction.

- Regulatory Compliance: Our tools help ensure compliance with safety regulations and standards, mitigating legal and financial risks associated with non-compliance.

Real-World Impact: A Success Story

A major energy transmission company in a fire-prone region faced soaring insurance premiums due to high fire risk. By implementing Echospectra’s fire risk abatement tools, the company conducted a thorough analysis of vegetation health and fire potential. They then executed targeted vegetation management strategies based on our recommendations. As a result, the company was able to demonstrate a significant reduction in fire risk, leading to a 25% reduction in their insurance premiums. Additionally, the company secured enhanced coverage options, providing greater financial protection and operational stability.

Conclusion

In today’s challenging environment, strategic fire risk abatement is not just a safety measure—it’s a financial imperative. Echospectra’s advanced tools empower energy companies to proactively manage fire risks, resulting in lower insurance costs and improved coverage options. By leveraging comprehensive risk mapping, AI-driven insights, targeted mitigation strategies, and real-time monitoring, we help our clients achieve operational resilience and financial savings.

For more information on how Echospectra can help you reduce insurance premiums and enhance coverage through strategic fire risk abatement, contact us today. Together, we can build a safer, more resilient future for your energy infrastructure.

Find out more about Fire Risk and Hazard Trees and explore new opportunities for innovations